working in nyc taxes

People trusts and estates must pay the New York City Personal Income Tax if they earn income in the City. Apply on company website.

Become An Nyc Free Tax Prep Volunteer

Best of all you wont have to pay NYC income taxes which only apply to residents of New York City.

. The only two NY cities that have a separate tax are Yonkers and NYC. Working In New York City Taxes. The 2021-2022 New York State budget also gives homeowners a break in the form of a tax credit for any portion of real property taxes that exceeds 6 of their qualified.

Cigarettes are subject to an excise tax of 435 per pack of 20 and other. June 4 2019 935 PM. The tax is collected by the New York State Department of Taxation and Finance.

Do you have to pay New York City tax if you dont live there. The tax is collected by the New York State Department of. The decision to live in New Jersey and work in New York might be cheaper on your taxes overall.

Income Tax Job Work from Home EA CPA or JD 100 Remote RemoteWorker US Buffalo NY. New York Tobacco Tax. Residents of New Jersey who work in New York will fill out both an NJ.

This memorandum explains the Tax Departments existing policy concerning employer withholding on the wages paid to certain. In most cases if you dont live in New York City you arent required to pay New York City personal income tax. People trusts and estates must pay the New York City Personal Income Tax if they earn income in the City.

As a nonresident you only pay tax on New York source income which includes earnings from work performed in New York State and income from real property located in the. If this status is established days spent working at home outside of New York will not count as New York-based days and therefore will not be taxed by New York. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

If an out-of-state employer agrees to withhold New York State New York City or Yonkers income taxes for the convenience of the employee then the employer is subject to. Who Work 14 Days or Fewer in New York State. The citys tax rates range from 3078 of taxable income to 3876 for top earners.

Get email updates for new Tax Specialist jobs in Buffalo NY. Sun Feb 06 2022 in Jobs. On the other hand many products face higher rates or additional charges.

One advantage to living in New Jersey while working for a New York Citybased company is you wont be subject to any NYC taxes as those city taxes are only relevant to. Working In New York City Taxes. Yonkers taxes you if you live or work in Yonkers but NYC only taxes you.

For instance the sales tax in New York City is currently 8875 while the sales tax rate in New.

Bill Rudin On Remote Work Nyc Property Taxes Tech Leasing

How Much Tax Is Deducted From A Paycheck In Ny Cilenti Cooper Overtime Lawyers In Ny

N J Could Grab Hundreds Of Millions In N Y Income Taxes Paid By Nyc Employees Now Working At Home In Jersey Nj Com

How Tax Brackets Work 2022 Tax Brackets White Coat Investor

Mansion Tax Nyc Pied A Terre Tax New York State Budget

New York Taxes Layers Of Liability Cbcny

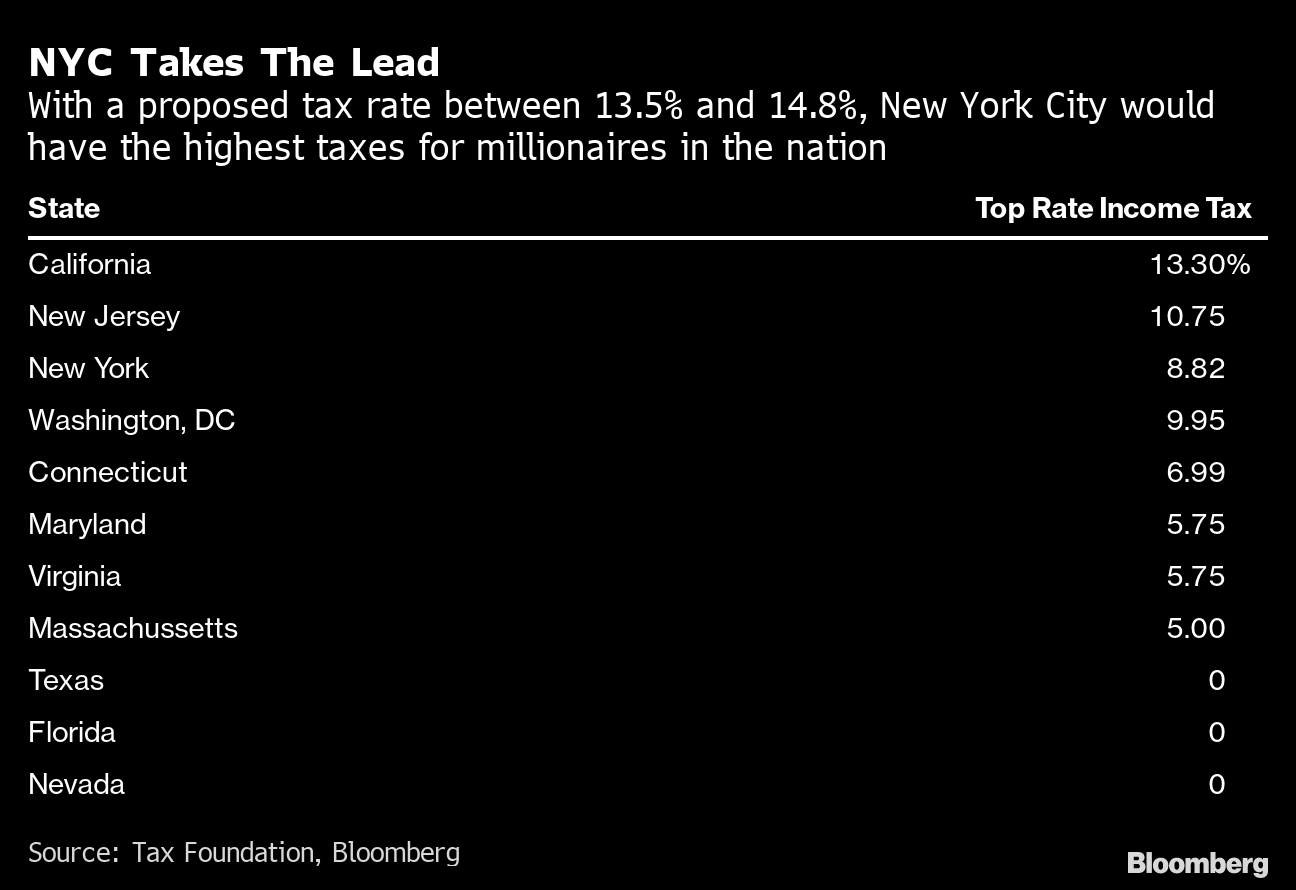

New York Tax Rates Nyc S Richest Face Top Rate Of Over 50 Under Cuomo S Plan Bloomberg

Nyc Nys Transfer Tax Calculator For Sellers Hauseit

Dca Consumers Manage Money File Your Taxes

The Difference Between Living In Nyc Living In San Francisco

Where S My New York Ny State Tax Refund Ny Tax Bracket

/GettyImages-538594694-791e2c621e27472fbdf9a3f1b7cfcb67.jpg)

Benefits Of Living In Nj While Working In Nyc

Live In Nj And Work In Nyc Where Do I Pay Taxes Streeteasy

Nyc How Do Quarterly Taxes Work In New York City Tax Services Nyc

New York Tax Rates Nyc S Richest Face Top Rate Of Over 50 Under Cuomo S Plan Bloomberg

Economic Nexus Adopted For Nyc Business Corporation Tax Pwc

What Taxes Do You Pay If You Live In New York City Work In New Jersey Sapling

What It Takes To Reduce Your Real Estate Taxes In Nyc Marks Paneth